Top free personal finance software like Mint, Personal Capital, YNAB, Goodbudget, and PocketGuard help you manage spending, save money, and plan for the future — all without spending anything.

Taking care of your money can seem hard sometimes. Bills, savings, expenses — it’s a lot to manage!

But with the right free personal finance software, you can make it much easier.

In this guide, you’ll find the best free tools that help you budget, save, and reach your financial dreams — all without spending a single dollar.

Why Should You Use Free Personal Finance Software?

Money management is an important life skill.

If you know where your money is going, you can:

- Save for things you love

- Pay off your debts faster

- Feel less stressed about money

- Plan for the future

- Build wealth over time

Many free apps today offer amazing features. You don’t need to hire expensive experts or spend hours with a calculator. These apps can help you stay on top of your money, easily and quickly.

Top Free Personal Finance Software to Try:

Here’s a list of the best free software that can help you take control of your finances today:

1. Mint

Best For: Beginners and everyday budgeting

Key Features:

- Connects to your bank accounts automatically

- Tracks your income and expenses

- Sends alerts if you go over budget

- Reminds you to pay your bills

- Gives you a free credit score

Why People Love It:

Mint is simple to set up and even easier to use. It shows all your money in one place so you always know where you stand.

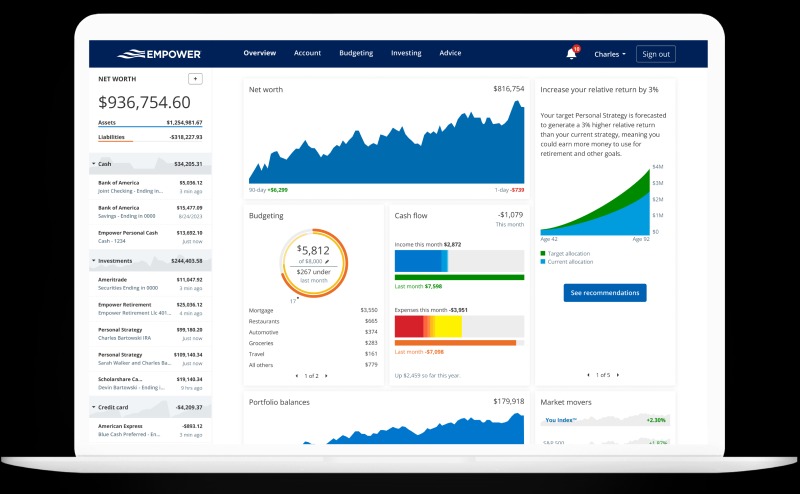

2. Personal Capital (Now called Empower)

Best For: Budgeting and investment tracking

Key Features:

- Tracks spending, saving, and investments

- Helps you plan for retirement

- Shows your net worth

- Offers free financial planning tools

Why People Love It:

It’s great for people who want to manage their daily budget and see how their investments are growing.

3. YNAB (You Need A Budget) — Free for Students

Best For: People who want to plan every dollar carefully

Key Features:

- Teaches you how to “give every dollar a job”

- Helps you save for big goals

- Shows you how to pay off debt faster

- Great customer support and training videos

Why People Love It:

YNAB makes you more mindful about your money. Students get a full year free, which is an amazing deal!

4. Goodbudget

Best For: Old-school “envelope” budget fans

Key Features:

- Lets you divide your money into digital “envelopes” (like Rent, Groceries, Gas, etc.)

- Works well for couples or families

- No need to link your bank accounts if you don’t want to

Why People Love It:

It’s very visual and helps you stick to your budget easily.

5. PocketGuard

Best For: People who overspend easily

Key Features:

- Tells you how much money you can safely spend

- Tracks all your bills and subscriptions

- Protects your data with strong security

Why People Love It:

PocketGuard helps you avoid spending money you don’t have by showing your “safe to spend” amount after all your bills and goals are covered.

Other Good Free Finance Apps to Consider

While the apps above are some of the best, here are a few more you might like:

- EveryDollar: Simple zero-based budgeting app by Dave Ramsey.

- Honeydew: Great for couples who want to share their finances.

- Zeta: Another app made for managing money as a couple.

- Spendee: Colorful design with great tracking for shared accounts.

These apps have free versions that are perfect if you’re just getting started.

How to Pick the Best Personal Finance Software for You?

Choosing the right tool depends on what you need. Ask yourself:

- Do I just want to track spending? → Mint or PocketGuard

- Do I want to plan my money in detail? → YNAB or Goodbudget

- Do I also want to track investments? → Personal Capital

- Am I managing money with a partner? → Goodbudget, Honeydew, or Zeta

Also, think about if you want an app that links to your bank automatically or if you prefer adding things manually. Some people like seeing everything in real-time, while others like more privacy.

How Personal Finance Apps Can Help You Unlock Your Financial Potential

When you use a good finance app regularly, you will:

- See exactly where your money goes

- Find ways to save more every month

- Stay out of debt or pay off debts faster

- Set financial goals and actually reach them

- Build confidence in managing your own money

Many people who start tracking their money for the first time feel like they “found” extra cash they didn’t know they had.

That’s the power of awareness!

Small steps every day turn into big financial wins over time.

Quick Summary Table

| Software | Best For | Main Features |

| Mint | Beginners | Automatic tracking, free credit score |

| Personal Capital | Investors | Budget + investments + net worth |

| YNAB (Students) | Careful budgeters | Full control of every dollar |

| Goodbudget | Couples/families | Easy envelope system |

| PocketGuard | Spend control | Safe-to-spend tracking |

FAQs:

1: What is the best free personal finance software for beginners?

Mint is the best choice for beginners because it automatically tracks spending, sends alerts, reminds you of bills, and even provides a free credit score in a simple dashboard.

2: Can free finance apps really help me save money?

Yes! Free apps like PocketGuard and Goodbudget show where your money goes, help you set savings goals, and guide your daily spending to avoid overspending and boost your savings.

3: Which finance app is best for couples managing money together?

Goodbudget is great for couples. It uses a virtual envelope system, allowing both partners to easily track spending, budget together, and stay on the same page financially.

4: Do free personal finance apps track investments too?

Yes. Personal Capital (now called Empower) is a free tool that not only tracks your budget but also monitors your investments, retirement savings, and overall financial health in one place.

5: How do I choose the right personal finance app for me?

Pick based on your needs: Mint for easy tracking, YNAB for deep budgeting, Personal Capital for investments, Goodbudget for couples, and PocketGuard if you struggle with overspending.

Conclusion:

Managing your money doesn’t have to be expensive or complicated. With the right free personal finance software, you can take full control of your budget, savings, and financial goals. Apps like Mint, Personal Capital, and Goodbudget make it easy to track spending, plan for the future, and avoid debt. Start small, stay consistent, and watch your financial health grow. Your future success begins with smart money habits today!

Related Post:

- Kuta Software Infinite Algebra 1 – Complete Guide for Teachers, Students, and Parents!

- Great Plains Software – Complete Beginner’s Guide!

- Staff Software Engineer Salary – Complete Guide For 2025!